The News

Export potential for the UK market

The UK is currently one of the most important economic partners of Vietnam. The UK is the 3rd largest trading partner of Vietnam in Europe (after Germany and the Netherlands) and the 6th largest import market of Vietnam in this region. Vietnam currently ranks 26th among the largest foreign suppliers of goods to the UK market with a turnover of 5-6 billion USD/year.

1. Bilateral trade between Vietnam and the UK and Vietnam's export potential

The UK is currently one of the most important economic partners of Vietnam. The UK is the 3rd largest trading partner of Vietnam in Europe (after Germany and the Netherlands) and the 6th largest import market of Vietnam in this region.

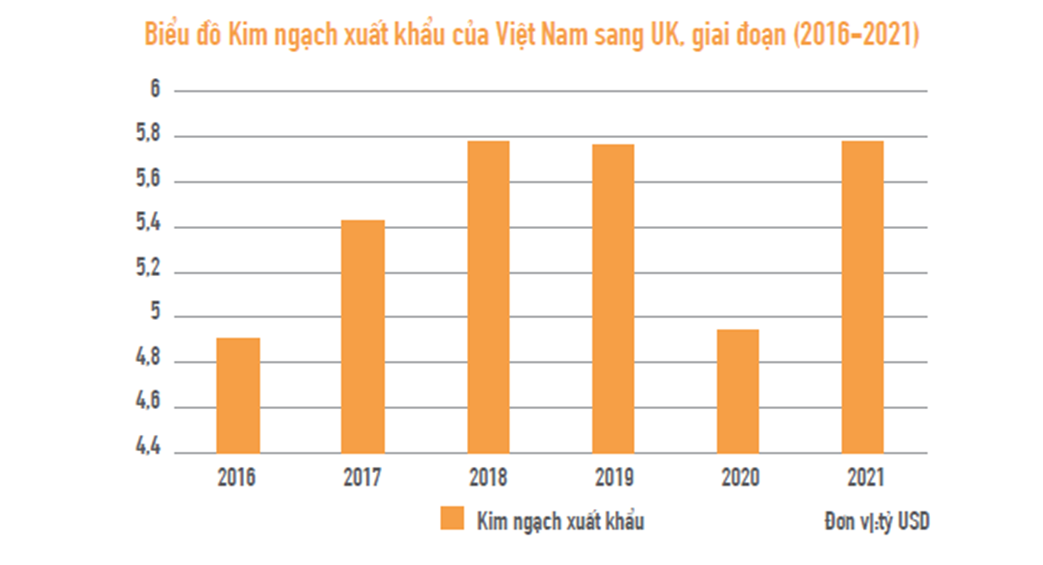

Bilateral trade turnover between Vietnam and the UK grew positively in the period of 2016-2020 and remained at over 5.6 billion USD. In the 2016-2019 period, trade turnover grew at an average rate of 5.7%, from 5.6 USD billion in 2016 to over 6.6 USD billion in 2019. In 2020, due to the impact of the COVID-19 pandemic, the two countries' trade turnover decreased by 14.7% compared to 2019. For 5 consecutive years, the trade surplus from Vietnam to the UK has always been over 4 billion USD per year.

Vietnam currently ranks 26th among the largest foreign suppliers of goods to the UK market with a turnover of 5-6 billion USD/year.

In 2021, the total export turnover between Vietnam and the UK reached 6.6 billion USD, up 17.2% compared to 2020. Exports from Vietnam reached nearly 5.8 billion USD, up 16.4%, imports reached 849 million USD, up 23.6%. Vietnam's exports to the UK increased sharply thanks mainly to the UKVFTA (exemption and reduction of import duties on many types of originating goods imported into the UK) and the recovery of the supply chain after the pandemic.

Most of Vietnam's exports to the UK in 2021 grew, of which the product with the highest increase was iron and steel of all kinds, up to 1269%. Iron and steel products increased by 91.9% and ranked 2nd. Steel exports to the UK in 2021 increased sharply by 708%, reaching 418,903 tons, with an average price of 1172.7 USD / ton, up 69.5% compared to last year. The sudden growth in the export value of iron and steel item is due to the strong increase in iron and steel demand due to the recovery of iron and steel industries in Europe after the pandemic. On the other hand, it is also due to the continuous increase in Vietnam's steel production in recent years.

In terms of imports, in 2021 import of pharmaceuticals increased the most, reaching 107 million USD, which is equivalent to an increase of 35.2%. Other outstanding import growth include: cars of all kinds (29%); computers, electronic products and components (24.7%); fodder and raw materials (16.5%); machinery and equipment (11.8%).

2. Consumption and import trends of the UK market

An aging population leads to the priority of choosing items with health value. The aging population will lead to an increased demand for healthy foods, instead of the pricing factor – which is the current top concern. Therefore, healthy food items will be a new import trend that Vietnam should aim for if it wants to export goods into the UK.

The tendency to choose processed products. With the economy returning to post-COVID-19 normal and people going to work normally, UK residents will not have time to cook. This is the major reason driving the market for processed foods.

Reduce spending on non-essential products amid rising inflation globally.The Consumer Price Index including the cost of owner's housing (CPIH) rose 8.2% in the 12 months to June 2022, up from 7.9% in May. The impact of rising inflation due to the Russia-Ukraine conflict and rising energy prices has undermined British consumer confidence, household purchasing power as well as discretionary spending by the British public. Many shoppers have started buying cheaper substitutes for the products they normally buy while also looking for more coupons or discounts than they used to and not even spending on some unnecessary groceries anymore. Businesses need to focus on improving the quality, design, trademark or environmental benefits of products while ensuring competitive prices to attract consumers.

The COVID-19 pandemic has drastically impacted consumer behavior.More than 60% of UK consumers change the store, brand or way they shop, and up to 50% of consumers reduce spending for most discretionary categories. More and more British consumers are turning to online purchases and services, and many intend to continue after the pandemic is over.

Prioritize the selection of products of high quality and ensure ethical and environmental standards. Ethical and environmental business practices are becoming increasingly important to British consumers. Sales of organic products have increased over the years. According to Soil Association’s data, organic product sales grew by 5.2% in 2021. The purchase of organic products is usually carried out in independent stores or home delivery. The consideration for the environmental impacts also encourages the circular economy and second-hand markets. According to Ibis World, the market size of the second-hand trading industry in the UK has declined by an average of 3.3% per year between 2017 and 2022, but is expected to grow by 24% in 2022.