The News

Updated policy and business rights in the state of Israel

Israeli recently has issued a number of notable policies, including: signed the Treaty on Avoiding Double Taxation and the Framework Agreement on Economic and Trade Cooperation with the UAE; amends the Law on Dairy Management; agree with dairy industry representatives to raise milk prices and expand duty-free cheese imports; signs agreement to supply gas to EU through Egypt; and reforms import regime and adopts EU standards.

Israeli recently has issued a number of notable policies, including: signed the Treaty on Avoiding Double Taxation and the Framework Agreement on Economic and Trade Cooperation with the UAE; amends the Law on Dairy Management; agree with dairy industry representatives to raise milk prices and expand duty-free cheese imports; signs agreement to supply gas to EU through Egypt; and reforms import regime and adopts EU standards.

I) Notable Policies

Israel signed the Treaty on Avoiding Double Taxation and the Framework Agreement on Economic and Trade Cooperation with the UAE

- On May 31, 2021, Israel and the United Arab Emirates (UAE) signed a Treaty to avoid double taxation to promote the development of trade and investment cooperation between the two countries since the two sides normalized relations last year. With provisions on non-discrimination, information exchange and prevention of abuse, the treaty provides solid guarantees and creates favourable conditions for investors and businesses of the two countries to open their doors. expand business cooperation activities with each other, through tax reduction. It is expected that this agreement will be approved by the Israeli Parliament and then the two sides will notify each other of ratification by the end of this year for the agreement to take effect from January 1, 2022. The Double Taxation treaty between Israel and the UAE will allow a strong promotion of investment and trade activities, thereby contributing to positive support between the two economies, as well as complementing each other, contributing to the prosperity of the entire region.

- On June 30, 2021, Israel and the UAE signed a framework agreement on economic and trade cooperation between the two countries with a term of 5 years, including the establishment of the Joint Committee on Economic Cooperation led by the United Arab Emirates. Economic Ministers of the two countries as co-chairs, to further promote bilateral cooperation and remove barriers, on the occasion of the official visit to the UAE by Israeli Foreign Minister Yair Lapid. The Agreement will be ratified by the two governments soon and will be automatically extended for the next 5 years, after its expiration.

Israel amends the Law on Dairy Management

On June 25, 2021, the Minister of Agriculture and Rural Development Oded Forer announced that the Ministry has proposed to amend the Law on Israel's Dairy Management in order to expand the production of milk varieties and to reduce the price of milk, which is expected to be around 2.5%. In practice, it is often the cause of price increases for finished dairy products controlled by the state.

Israel's Ministry of Agriculture and Rural Development and Ministry of Finance agree with dairy industry representatives to raise milk prices and expand duty-free cheese imports

At the end of June 2022, Israel's Ministry of Agriculture and Rural Development and Ministry of Finance reached an agreement with representatives of the dairy industry, according to which the regulated price of dairy products will increase by one-third, and the price increase of managed products will be only 4.9%, instead of 14% as was initially expected to increase. This price will be kept stable, unchanged for at least one year. In addition, the target price (the price that dairy ranchers receive from dairy firms) will decrease by 2.15 cents (agurot) per quarter for a year.

The Parties also agreed that import duties on hard cheeses, such as mozzarella, halloumi, jamid (kishk) and gorgonzela, would be abolished immediately, and import duties on soft cheeses (cream) with a fat percentage higher than 5% will be phased out gradually. Thus, at the beginning of 2023, the applicable import tax will be reduced by 50% and one year later, in 2024, the import tax will be completely abolished. Furthermore, duty-free import quotas for dairy products will be increased in line with domestic consumption figures.

In addition, from May 2023, the prices of dairy products under supervision will be updated through an automatic mechanism, based on decisions of the Inter-Ministerial Pricing Committees of the Ministry of Finance and the Ministry of Agriculture and Rural Development, and so there is no need for Ministers to sign orders to impose prices. In this context, the cost of milk production will be calculated in accordance with the annual production costs of large farms, where the production quota is 800,000 litres or more. These are understood to be large, efficient farms and their production costs are optimal.

Israel signs agreement to supply gas to EU through Egypt

On June 15, 2022, Israel and Egypt signed a tripartite agreement on the export of Israeli gas to the EU through Egypt. The signing ceremony took place at the Eastern Mediterranean Energy Forum Ministerial Meeting held in Cairo, Egypt, attended by European Commission President Ursula von der Leyen, shortly after Lady von der Leyen has just concluded a visit to Israel with the main purpose of discussing the issue of gas supplies. The agreement was signed by Israel's Minister of Energy, Infrastructure and Water Resources, Karine Elharrar, along with her Egyptian and EU counterparts.

The deal is part of the EU's effort to secure new supplies of natural gas following supply disruptions from Russia. The agreement is valid for three years and will automatically renew for the next two years. Under the agreement signed today, the parties will work together to facilitate the regular supply of gas from Israel, Egypt and other sources to the EU, through existing gas pipelines in Israel and existing liquefied natural gas (LNG) facilities in Egypt. This will depend on the availability and security of energy in each signatory's domestic markets, and Israel and Egypt will not be prevented from exporting gas to other markets. Part of the agreement also states that the EU will encourage European companies to participate in competitive processes and invest in gas exploration and production projects in Israel and Egypt. In addition, the parties will develop an infrastructure optimization program, examine the need for new LNG plants, and map out a roadmap to expedite the approvals necessary to implement the provisions of the agreement. recently signed agreement. The parties will also take action to reduce methane emissions and will test innovative technologies for methane capture throughout the supply chain. The agreement even includes jointly examining carbon capture possibilities as part of a joint plan to reduce emissions and decarbonize the natural gas industry, as well as investment avenues. technologies in that area.

Israel currently exports 8 billion cubic meters of natural gas per year and in addition, Israel has a surplus of another 4 billion cubic meters that can be used for export after meeting its domestic demand. The aim is to expand exports after gas production starts from existing and proven resources and to expand further when the gas source is confirmed during the upcoming exploration and in the licensing of exploration in a new tender that is expected to be held soon in the near future.

Israel reforms import regime and adopts EU standards

On September 28, 2022, Prime Minister Yair Lapid announced that Israel will have some major adjustments to the food import market to be implemented on January 1, 2023. Israel is working to bring those EU standards to Israel and the Israeli government has made an important decision to apply EU standards towards the goal from January 2023 for goods. If it's cheap in Germany, it'll be cheaper in Israel as well. Prime Minister Yair Lapid also added that the process of adjusting standards in Israel to European standards would reduce the cost of living and open up the food market to competition. The Government of Israel will continue to act in the interests of the Israeli people so that they can consume safe, diverse food items at competitive prices.

The Israeli Ministry of Finance said that, after being reviewed by the Israeli Food Standards Review Committee, 97 Israeli food standards will be completely cancelled for Israeli importers and 19 standards will be cancelled “almost completely” in the next four years. Specifically, for domestic manufacturers, out of the 97 standards mentioned above, there are 60 standards to be eliminated on January 1, 2023, 21 standards to be phased out a year later, and 01 standards to be phased out one year later, and finally, 15 standards are set to be phased out on August 1, 2026. This cancellation will open up the Israeli food market to foreign suppliers and provide a wider variety of food choices for Israeli consumers while tending to lower prices due to international competition. freer market. The abolition of these food standards will facilitate the importation and production of a wide range of products including ice cream, ketchup, tea, dairy products, pasta, rice, crackers, dried fruits, jams, a variety of frozen vegetable products, condiments, dry soups, mustard, mayonnaise and many more. Previously, Israel also implemented a new import policy/reform program from June 1, 2022, on market opening, removing trade barriers, and reducing specific standards of the country. Israel applies international standards and practices... for a wide range of goods, mainly focusing on consumer goods, household goods, furniture, sporting goods, electronic products, appliances kitchen, building materials, electrical appliances of all kinds, bicycles, children's appliances, communication and telecommunications equipment...

II) Learning about business and business rights in Israel

1. Types of businesses

- Company: The Israeli Companies Regulation defines a corporation as a business company incorporated and registered in Israel, under the laws of Israel. Most companies limit the personal liability of their owners, usually in the form of shares. In this case, the term "Limited" (or the abbreviation "Ltd.") must appear as part of the full name of the company.

- Private company: Consists of 1-50 shareholders, may not offer or sell bonds or shares to the public.

- Limited joint stock company: A company that registers shares on the stock exchange, or offers shares to the public in Israel through a prospectus as required by the Israeli Securities Law.

- Foreign company: A merged foreign company may establish a place to do business (branch office, Israeli subsidiary (Israeli Registered Company)) in Israel provided that it was registered as an offshore company with the Registrar of Companies.

Non-Profit Organizations: A Non-Profit Organization (NPO) is a general term that includes organizations, associations, and public companies that are dedicated to the public good and use their funding to advance and enhance those benefits, without sharing the profits, if any, among the members.

Cooperatives: Cooperatives are a relatively new form of corporation. The cooperative works to promote the welfare of its members, unlike the NPO it does not deny the option of profit sharing among the members.

- Partnership: The partnership regulation defines an entity consisting of people who enter into a contract with the purpose of operating a business for profit. The personal liability of partners is not limited unless they are limited partners of limited partners. A foreign partnership is also allowed to do business in Israel.

2) Intellectual property in Israel

In Israel, Patents, Designs and Trademarks and Grants of Legal Protection are authorized by the Intellectual Property Office of Israel. The IPO operates under the auspices of the Department of Justice.

Patents in Israel are organized under the "Patent Law" (1967). By law, a person who is inventive, potentially useful, and advanced in his or her invention is eligible to apply for a patent. Patents are licensed and legally protected in Israel by IPOs. Israel is a member of the PCT (Patent Cooperation Treaty). Since accession to the treaty in 1996, Israeli citizens or residents can apply for an international patent to seek international patent protection for their invention.

- Design: Design is registered as proprietary rights allowing protection of new or original industrial product designs. According to the Patent and Design Ordinance (1926), a design can be registered for any industrial object or product whose shape, design or decoration is conspicuous to the eye, that is new or original and has not been sold, sold or published in Israel prior to application. Design registration is under the jurisdiction of the IPO. An IPO-registered design grants the owner the exclusive right to use the design found only in Israel. In addition, Israel is a party to the Treaty of Paris. Membership allows applicants to submit an application design in Israel to claim the same priority date for the same design in other member countries.

- Brand: The IPO is also in charge of trademarks. Trademark registration in Israel provides protection only in Israeli territory and is applied only under Israeli jurisdiction. In addition, Israel has acceded to the Madrid Protocol; therefore, Israeli applicants can simultaneously submit a unique trademark application that can be automatically applied in more than 90 countries. The records are made according to the Madrid System.

3. Antitrust Law

Businesses in Israel also need to pay attention to antitrust laws. In there:

- Restrictions on Israel's Commercial Practice Law: The Commercial Practice Law is the main law restricting the commercial sector. The law is designed to prevent businesses from causing fear of free competition in the market. The law allows the Israel Antitrust Authority (IAA) to act when free competition in a certain market or sector could be negatively impacted by business activity.

- Law on Promotion of Competition and Decentralization:The law was enacted in 2013 and deals with three aspects of competition promotion: Essential market and state considerations on the allocation of public assets, limits institutionalized control over pyramidal companies and segregated large non-financial corporations and large financial institutions.

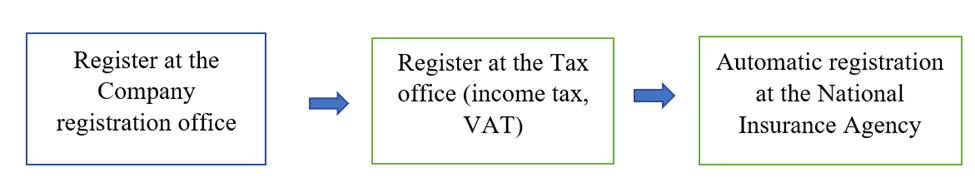

4. The process of starting a business/starting a business

Register your business at the The Company registration office

All companies in Israel are required to register with the Company registration office. In order for a foreign company to have a legal place of business in Israel, an Israeli branch office and a subsidiary must be registered, and both are separate registered legal entities.

The following documents must be submitted to the Company registration office in order to legally register a foreign company in Israel:

1. List of directors of the company, including their passport numbers.

2. Power of attorney giving the Israeli representative the responsibility of officially representing the company in Israel

3. Full name, address and identifying information of the Israeli representative appointed to receive legal notices on behalf of the company

4. The Charter of the Company and the Hebrew translation must be notarized.

5. Certificate of incorporation from the country of origin signed by Apostille-Consular Legalization. In the event that the certificate is not issued by the country of origin, the attorney dealing with the registration should send a signed letter stating that the certificate was not issued in the country of origin, in addition to official documentation stating the company registered with the Company registration office in the country of origin.

6. The company establishment certificate translated into Hebrew must be notarized.

7. Documents proving that the company is operating in the country of origin and the translation of such documents into Hebrew and all must be notarized in the country of origin.

8. Proof of payment of registration fee (currently 2,606 NIS (approximately 711.5 USD). The company can submit the application by mail or in person, with the registration form. Can apply online (online) Foreign company registration is processed within 14 working days.

(The information about the Israeli market is provided by the Vietnam Trade Office in Israel)