The News

Potential of food processed export to Singapore

Singapore is a country without agriculture, most materials for production dependent upon imports, but Singapore is the 12th largest export of processed food. In the first 9 months of 2022, Singapore's processed food export is $5.8 billion USD, the main export products are sauces, spices, instant food, noodles, sausages, confectionery and snacks.

Singapore is a country without agriculture, most materials for production dependent upon imports, but Singapore is the 12th largest export of processed food. In the first 9 months of 2022, Singapore's processed food export is $5.8 billion USD, the main export products are sauces, spices, instant food, noodles, sausages, confectionery and snacks.

Singapore is a country without agriculture, most materials for production dependent upon imports, but Singapore is the 12th largest export of processed food. In the first 9 months of 2022, Singapore's processed food export is $5.8 billion USD, the main export products are sauces, spices, instant food, noodles, sausages, confectionery and snacks.

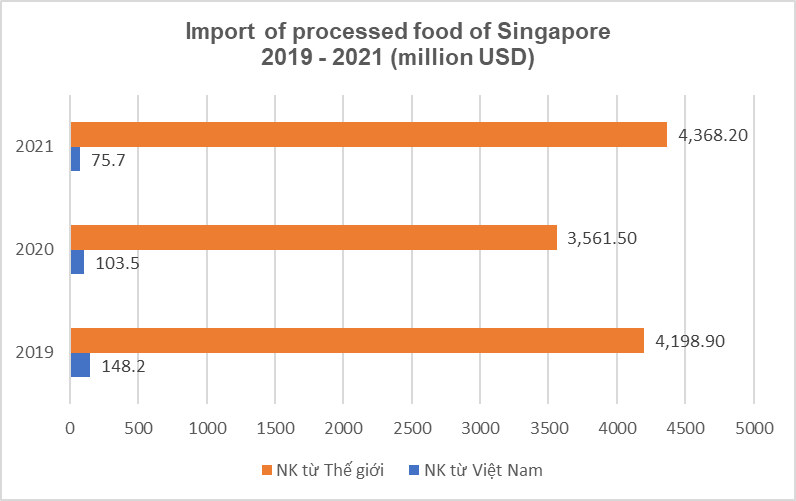

Vietnam is a country with strengths in the food and food processed industry but the export of processed food has not been commensurate with its potential. Vietnam is currently exporting raw products and re-importing food at high prices. In the period of 2017-2021, although Vietnam's agricultural exports to Singapore increased slightly by 2%, but there is manly export of raw products such as rice, seafood, vegetables and fruits, the value of processed foods export is not significant. In 2021, the exports of processed foods from Vietnam to Singapore is $3.5 million, accounting for 0.31% of the market share. Singapore mainly imports processed foods from Malaysia (19.6%), Indonesia (16.1% market), US (13.8%), China (11.4%), and Japan (5.6%).

Singapore is a country without agriculture, most materials for production dependent upon imports, but Singapore is the 12th largest export of processed food. In the first 9 months of 2022, Singapore's processed food export is $5.8 billion USD, the main export products are sauces, spices, instant food, noodles, sausages, confectionery and snacks.

Vietnam is a country with strengths in the food and food processed industry but the export of processed food has not been commensurate with its potential. Vietnam is currently exporting raw products and re-importing food at high prices. In the period of 2017-2021, although Vietnam's agricultural exports to Singapore increased slightly by 2%, but there is manly export of raw products such as rice, seafood, vegetables and fruits, the value of processed foods export is not significant. In 2021, the exports of processed foods from Vietnam to Singapore is $3.5 million, accounting for 0.31% of the market share. Singapore mainly imports processed foods from Malaysia (19.6%), Indonesia (16.1% market), US (13.8%), China (11.4%), and Japan (5.6%).

Singapore is a country without agriculture, most materials for production dependent upon imports, but Singapore is the 12th largest export of processed food. In the first 9 months of 2022, Singapore's processed food export is $5.8 billion USD, the main export products are sauces, spices, instant food, noodles, sausages, confectionery and snacks.

Vietnam is a country with strengths in the food and food processed industry but the export of processed food has not been commensurate with its potential. Vietnam is currently exporting raw products and re-importing food at high prices. In the period of 2017-2021, although Vietnam's agricultural exports to Singapore increased slightly by 2%, but there is manly export of raw products such as rice, seafood, vegetables and fruits, the value of processed foods export is not significant. In 2021, the exports of processed foods from Vietnam to Singapore is $3.5 million, accounting for 0.31% of the market share. Singapore mainly imports processed foods from Malaysia (19.6%), Indonesia (16.1% market), US (13.8%), China (11.4%), and Japan (5.6%).

Processed food is a potential product for Vietnamese enterprises to join the retail chain of Singapore and increase the export value of Vietnamese food products to Singapore in particular and the world in general. However, besides the advantages and potential of agricultural products and processing industry, Vietnam also faces many difficulties to increase the value of export to Singapore: (i) Processing transformation, preservation, design, brand… of Vietnam enterprises have not been focused. The value chain of agricultural exports is still weak, leading to unstable quality, price and consumption; (ii) The cost of shipping and distribution is very high in Singapore therefore Vietnamese SMEs could not afford to pay in the long term; (iii) Vietnamese enterprises have few competitive opportunities in terms of communication and promotion to consumers.

Processed food is a potential product for Vietnamese enterprises to join the retail chain of Singapore and increase the export value of Vietnamese food products to Singapore in particular and the world in general. However, besides the advantages and potential of agricultural products and processing industry, Vietnam also faces many difficulties to increase the value of export to Singapore: (i) Processing transformation, preservation, design, brand… of Vietnam enterprises have not been focused. The value chain of agricultural exports is still weak, leading to unstable quality, price and consumption; (ii) The cost of shipping and distribution is very high in Singapore therefore Vietnamese SMEs could not afford to pay in the long term; (iii) Vietnamese enterprises have few competitive opportunities in terms of communication and promotion to consumers.

Processed food is a potential product for Vietnamese enterprises to join the retail chain of Singapore and increase the export value of Vietnamese food products to Singapore in particular and the world in general. However, besides the advantages and potential of agricultural products and processing industry, Vietnam also faces many difficulties to increase the value of export to Singapore: (i) Processing transformation, preservation, design, brand… of Vietnam enterprises have not been focused. The value chain of agricultural exports is still weak, leading to unstable quality, price and consumption; (ii) The cost of shipping and distribution is very high in Singapore therefore Vietnamese SMEs could not afford to pay in the long term; (iii) Vietnamese enterprises have few competitive opportunities in terms of communication and promotion to consumers.