The News

Key content of the Border Carbon Adjustment Mechanism (CBAM)

The European Commission EC issued a List identifying the sectors and subsectors considered to be at risk of carbon leakage for the period 2021-2030 . The risk level of an industry/subsector is determined by its carbon leakage indicator. This index is influenced by two main components: (i) the trade intensity of that sector/sub-sector with a third country (non-EU), and (ii) the emission intensity) of the industry/sub-sector.

CBAM was first formally proposed on 11 December 2019 within the framework of the EU Green Deal and approved by the European Parliament (EP) on 10 March 2021.

On 15 February 2019, the European Commission EC issued a List identifying the sectors and subsectors considered to be at risk of carbon leakage for the period 2021-2030 [1]. The risk level of an industry/subsector is determined by its carbon leakage indicator. This index is influenced by two main components: (i) the trade intensity of that sector/sub-sector with a third country (non-EU), and (ii) the emission intensity) of the industry/sub-sector.

- Regulated fields

According to the draft CBAM , there are 63 sectors and sub-sectors considered to be at high risk of carbon leakage, focusing on the following areas: mining and mineral processing, production and processing of certain foods, products manufacturing a number of textile, chemical and construction products. These are the areas that are expected to be impacted the most when CBAM goes live.

According to the draft CBAM implementation announced by the EU on July 14, 2021, CBAM will initially apply to 5 groups of goods, namely cement, electricity, fertilizer, iron and steel, and aluminum when imported into the EU.

2. Implementation of the CBAM

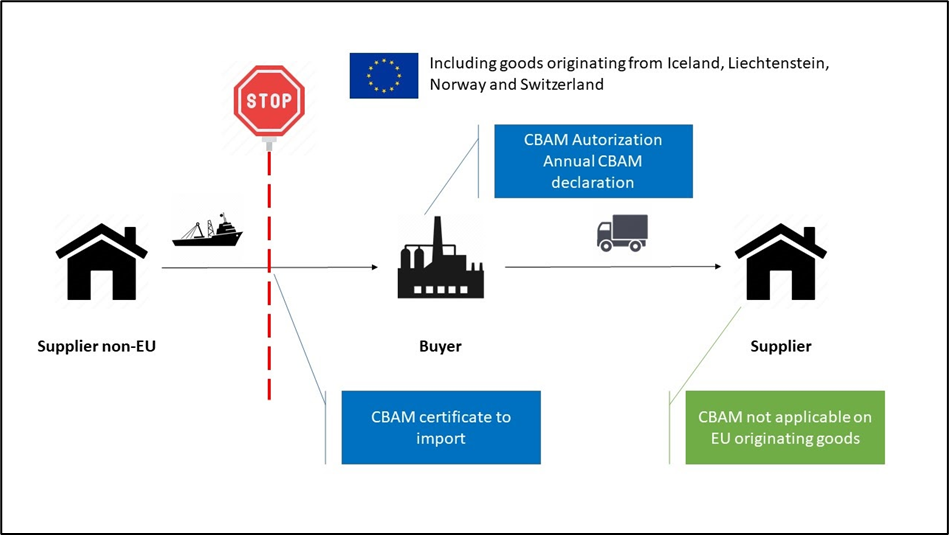

In terms of implementation, the EU will sell CBAM certificates (certificates) at an equivalent price under the ETS program so that customs declarants are licensed to import groups of goods, then submit them back at the end of the fiscal year (May 31 of each year) corresponds to the emissions calculated for the amount of goods imported into the EU in that year (and not for each shipment).

Emission calculations are not based solely on declaration, but must be verified by a third party licensed by the EU's CBAM agency. If not verified, the EU will generally rely on high levels of intra-regional emissions to attribute. In case imported goods have to pay emission prices in the producing country, the corresponding number of CBAM certificates will be deducted. The number of CBAM certificates to be submitted is reduced by the same amount as the number of free ETS issuances within the EU (to avoid the appearance of discrimination). The draft also envisages a three-year transition period. During the transition period, the EU will employ a simplified mechanism. After the transition period, the EU will fully apply CBAM. In addition, the EU is likely to sign agreements to consider the emission pricing mechanism in the country of origin of goods.

Proceeds from the sale of CBAM certificates will be included in the EU budget. The EU CBAM may ask for a guarantee in cases where the declarant is new or has not been trusted. The fine applied in case of violation is 3 times the monetary value of the CBAM certificate payable (plus the CBAM certificate must still be paid in full). Repeated violations will result in the deletion of the licensed customs declarant's account.

On June 22, 2022, the European Parliament EP adopted a common approach to CBAM with the following key points:

- Expand the range of products covered by CBAM , including certain products such as organic chemicals, plastics, hydrogen, ammonia;

- Expand the scope of emissions: accordingly, the calculation of emissions of a product includes both direct emissions and indirect emissions (e.g., electricity used in the production of that product) ;

- Extended transition period : The CBAM transition period will still start on January 1, 2023, but will end on January 1, 2027 (instead of January 1, 2025/6 proposed by the EC) before);

- The full implementation of this mechanism is earlier than expected, specifically in 2032 (i.e., 03 years earlier than the EC's proposal);

- Central authority: there will be a single EU body responsible for CBAM implementation on behalf of the regulatory bodies in each EU member state;

- Financial support to LDCs: Revenue generated from the sale of CBAM certificates should be allocated to the EU budget and then the EU must provide financial support, at least of a financial value equivalent to revenue generated from the sale of CBAM certificates, to support the efforts of LDCs to decarbonize their manufacturing industries.

The negotiation and commenting on the above draft law is expected to end by the end of 2022.

-cr-220x145.jfif)