The News

Australia Market Brief: Prawn

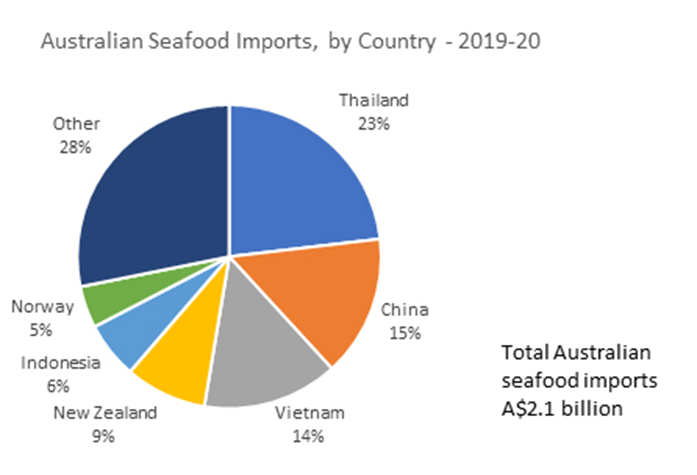

Despite the importance of Australian seafood exports to the profitability of the industry, Australia is a net importer of seafood. In 2019-20, Australia imported seafood valued at $2.1 billion from 97 countries. Six key countries accounted for 72 per cent of total Australian seafood imports.

Despite the importance of Australian seafood exports to the profitability of the industry, Australia is a net importer of seafood. In 2019-20, Australia imported seafood valued at $2.1 billion from 97 countries. Six key countries accounted for 72 per cent of total Australian seafood imports.

Australian seafood imports are to fill the gap between Australia's seafood consumption and local seafood supply. Whereas Australian fishery and aquaculture exports are dominated by high unit value products such as Rock Lobster, Atlantic Salmon, Southern Bluefin Tuna and Abalone. Imports of fishery and aquaculture products largely consist of lower unit value products such as canned or frozen finfish but also include higher unit value products such as prawns and salmonids.

Despite the importance of Australian seafood exports to the profitability of the industry, Australia is a net importer of seafood. In 2019-20, Australia imported seafood valued at $2.1 billion from 97 countries. Six key countries accounted for 72 per cent of total Australian seafood imports.

Basically, shrimp and shrimp products imported into Australia must meet one of the following conditions:

(i) Shrimp and shrimp products originating from a country/region recognized by Australia to be free of white spot disease (WSSV), yellow head disease (YHV), Taura syndrome (TSV) and bacterial hepatopancreatic necrosis disease (NHPB). Particularly, NHPB disease only applies to unfrozen products.

(ii) Shrimps were de-veined, peeled (except for the tail end) and tested and certified negative for WSSV and YHV.

(iii) Deeply processed shrimp (breaded, floured, marinated in wet or dry sauces, processed into fillings for dumplings, buns or similar products).

(iv) Shrimps are cooked.

In addition, detailed information on import conditions for each type of shrimp is posted at the website address below:

The following trading partners have confirmed that they can meet Australia’s enhanced import conditions for uncooked prawns: Argentina, Bangladesh, Brunei Darussalam, China, Denmark, Ecuador, India, Indonesia, Malaysia, Peru, Philippines, Thailand, United States of America, Vietnam.

The department continues to work with other trading partners (Madagascar, Myanmar and Saudi Arabia) to ensure safe trade can continue in uncooked prawns that meet Australia’s interim import conditions.

Consignments of imported uncooked prawns must meet biosecurity labelling requirements. These requirements include that:

- The primary packaging (i.e. the retail ready packaging) of the product is clearly labelled ‘For human consumption only – not to be used as bait or feed for aquatic animals’.

- Primary packaging must include the batch number. Batch numbers can be the best before date, but must match the batch number identified on the health certificate.

- The labels must be freezer grade labels

- The labels must be permanent (i.e. not easily removable)

- The labels must be stable at -20°C.

- Secondary packaging (i.e. the outer carton) is not considered the primary or retail ready package

Importers should also be mindful of food labelling requirements with other regulatory provisions, including food standards developed by Food Standards Australia New Zealand (FSANZ).

On August 19, 2022, the Australian Department of Agriculture, Fisheries and Forestry announced the addition of breaded, battered, or crumbed (BBC) shrimp and highly processed (HP) on the list of items eligible for incentives under the Incentive Intervention Program (CBIS) - A preferential mechanism for plant goods imported into Australia to enjoy a lower rate of biosecurity inspection. This loosened regulation is expected to help boost the export of processed shrimp from Vietnam to Australia from now until the end of the year.

According to the statistic of VASEP, as of October of 2022, Vietnam's shrimp exports to Australia reached nearly $214 million, up 62% over the same period in 2021. This is the highest growth rate among the top main shrimp import markets of Vietnam.

Also according to VASEP, Australia is Vietnam's second largest shrimp import market in the CPTPP market, accounting for 21% of Vietnam's total shrimp export value to this bloc. Australia is also the 5th largest Vietnamese shrimp import market, accounting for 6%. Processed shrimp is the most favorable product of Vietnam in Australia market, accounts for 40% of Vietnam's shrimp exports to Australia.

The main shrimp products of Vietnam currently being exported to Australia include boiled, headless and tailless frozen whiteleg shrimp; Frozen fresh PD headless and tailless whiteleg shrimp, frozen fresh PDTO headless shrimp, frozen PD IQF whiteleg shrimp, etc.

Australia is a difficult market with strict regulations on imported goods to protect food safety regulations. Enterprises that want to export in this market must actively improve the production process and quality of products.

Although inflation in Australia is high, it is still under the control of the Government. The Australian economy is forecast to be able to avoid a recession this year. Along with support from the RCEP and CPTPP Agreements that Vietnam and Australia have joined, Australia is still considered a potential market for Vietnamese shrimp in the near future.

-cr-220x145.jfif)